- Home

- Our Solution

Our Solution

What is a TPA

Third-Party Administrators (TPAs) serve as essential administrative support for self-funded companies. Typically, TPAs collaborate with brokers, consultants, and a company's HR team to develop and implement healthcare benefits plans aimed at improving employee benefits. Some key administrative responsibilities undertaken by TPAs include:

- Claims Processing: Managing the adjudication and payment of claims for members and providers.

- Plan Design and Implementation: Working with HR teams to create the most suitable plan for employees and assisting in its execution.

- Compliance Management: Ensuring that self-funded health plans adhere to local authorities.

- Member Services: Directly engaging with members to address their plan-related needs, handling member inquiries, and assisting high-risk members in accessing appropriate care.

- Network Administration: Negotiating contracts and pricing with providers and networks.

- Reporting and Analytics: Providing comprehensive, data-driven reports on plan utilization, expenses, and the overall health status of the employee population.

- Stop-Loss Management: Procuring and managing stop-loss carrier claims.

How to work with a TPA?

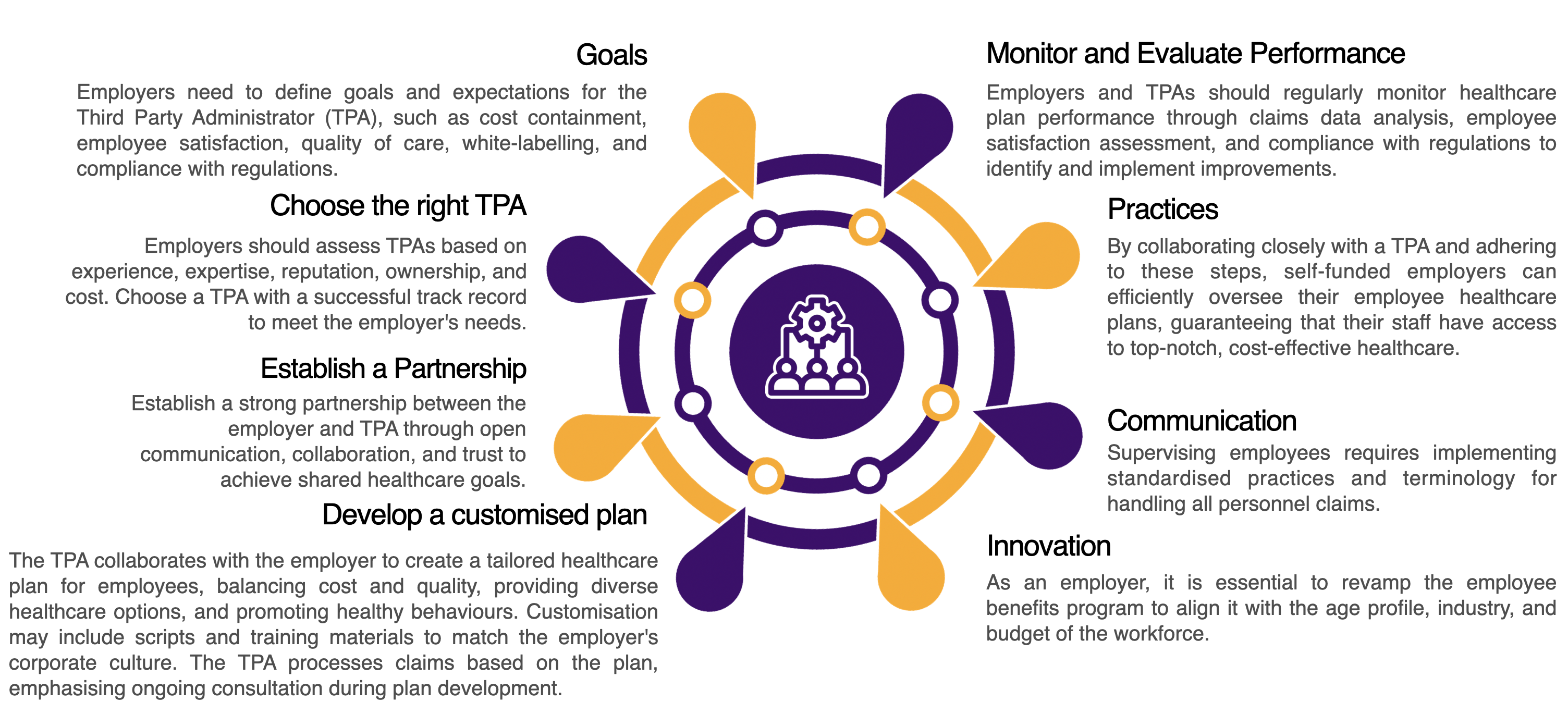

Third-party administrators (TPAs) serve as an extension of an employer's HR Department, assisting HR leaders in maximizing the effectiveness of their employee benefits plan. By delegating administrative tasks and claims management to a TPA, HR can concentrate on key areas such as employee retention, talent acquisition, organizational culture, and other C-Suite priorities.

TPAs work closely with their clients to create tailored solutions that meet their specific requirements from scratch. Following the implementation phase, TPAs oversee the health plan and fine-tune it to meet financial objectives through cost-effective strategies. To accomplish these objectives, TPAs rely on data analytics and insights obtained from utilization reports and clinical care management initiatives to direct employees to the most suitable healthcare services and ensure efficient claims processing.

Third-party administrators (TPAs) serve as an extension of an employer's HR Department, assisting HR leaders in maximizing the effectiveness of their employee benefits plan. By delegating administrative tasks and claims management to a TPA, HR can concentrate on key areas such as employee retention, talent acquisition, organizational culture, and other C-Suite priorities.

TPAs work closely with their clients to create tailored solutions that meet their specific requirements from scratch. Following the implementation phase, TPAs oversee the health plan and fine-tune it to meet financial objectives through cost-effective strategies. To accomplish these objectives, TPAs rely on data analytics and insights obtained from utilization reports and clinical care management initiatives to direct employees to the most suitable healthcare services and ensure efficient claims processing.

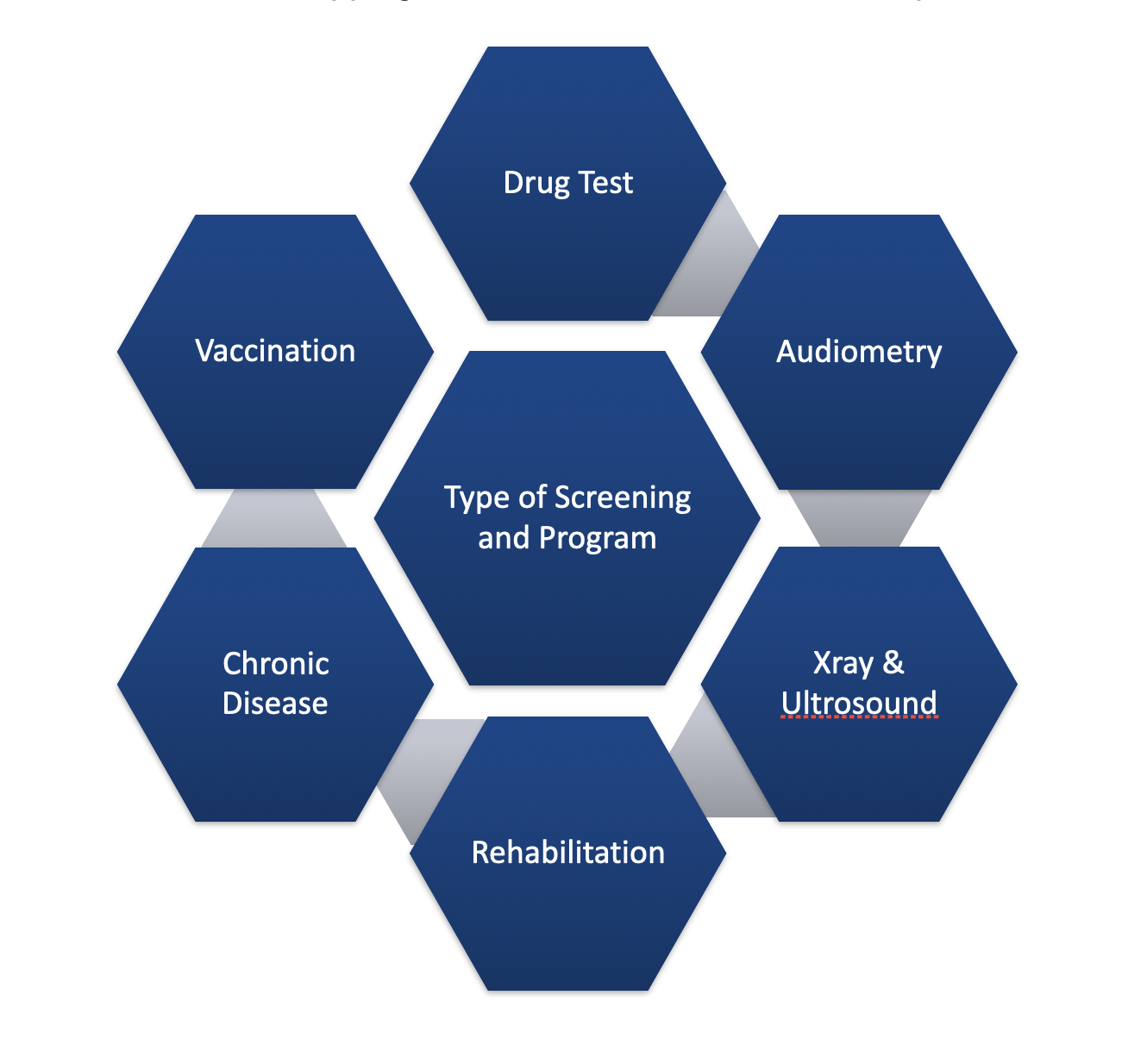

Types Of Corporate Programs

How do TPAs Save Time and Money?

Offering Network Flexibility

Third-Party Administrators (TPAs) collaborate with various payers and insurance companies to provide top-notch networks (such as Etiqa, Liberty or Takaful) along with their own Member Services, Technology, and Reporting and Analytics. TPAs can even facilitate direct contracts between employers and local healthcare providers or hospitals. This practice can effectively address challenges related to out-of-network and out-of-area providers.

Optimising Allocation of Funds

A TPA partner can help employers save money by using analytics to pinpoint wasted funds from underutilized programs. TPAs can recommend either boosting engagement with specific programs or optimizing the plan for the next year by introducing alternative programs that will be utilized more effectively.

Third Party Administrators (TPAs) specialized knowledge enables us to handle tasks more effectively, cutting down on administrative expenses that would otherwise be handled internally. Some of the ways they achieve this include (but are not limited to):

Remaining Compliant

Third-party administrators (TPAs) excel in maneuvering through the intricate realm of healthcare regulations and compliance. TPAs are skilled in the rules and regulations linked to benefit plans, assisting employer organizations in staying compliant with the most recent state and federal regulations. Their proficiency aids employers in mitigating the risk of incurring expensive fines and penalties unknowingly.

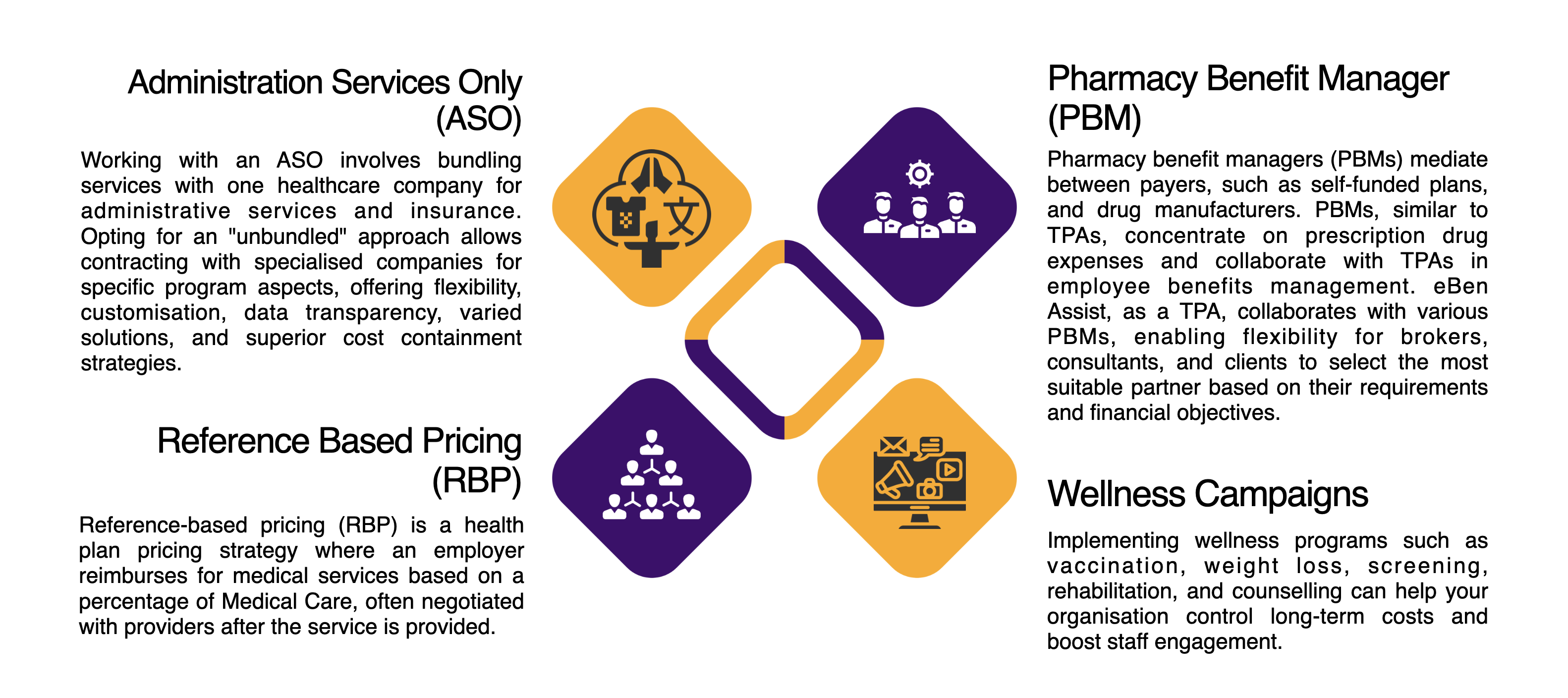

Enabling unbundling & Carve-out Strategies

Several network carriers mandate that employers purchasing through them must also acquire their preferred Pharmacy Benefit Manager (PBM) along with network and administration services. Third-Party Administrators (TPAs) offer employers the flexibility to choose a provider network independently from the bundled Pharmacy Benefit Manager (PBM). This approach can be beneficial in cutting costs while enhancing access to healthcare services.

Third Party Administrators (TPAs) focus on benefits administration to enhance plan utilization and minimize waste compared to internal management. They utilize various methods to efficiently handle tasks and reduce administrative costs.

Providing Superior Technology

A contemporary TPA provides technological solutions to enhance backend efficiency for employers and streamline processes for employees and providers. This is crucial during enrollment and for maintaining a positive member experience. Employers can benefit from features like consolidated billing and customized reporting, which help reduce administrative workload.

Clinical Care Management

TPAs help reduce costs through services like pre-admission counseling and care coordination, saving time and money for both companies and employees. eBen Assist uses data analysis to identify risks and find cost-effective solutions. A success story involved the Case Management team providing affordable treatment options. TPAs offer innovative health plans like reference-based pricing by negotiating competitive rates with providers. They address common inquiries about plan selection for self-funded employers.

How Do TPAs Improve Employee Health?

Working with a Third-Party Administrator (TPA) can improve employee well-being through customized health programs like maternal health initiatives, behavioral health, chronic condition management, and wellness programs. TPAs analyze plan data to identify gaps and offer preventive solutions. Employee engagement programs promote healthy behaviors and empower individuals to manage their health. Clinical care management by TPAs directly impacts employee health outcomes.

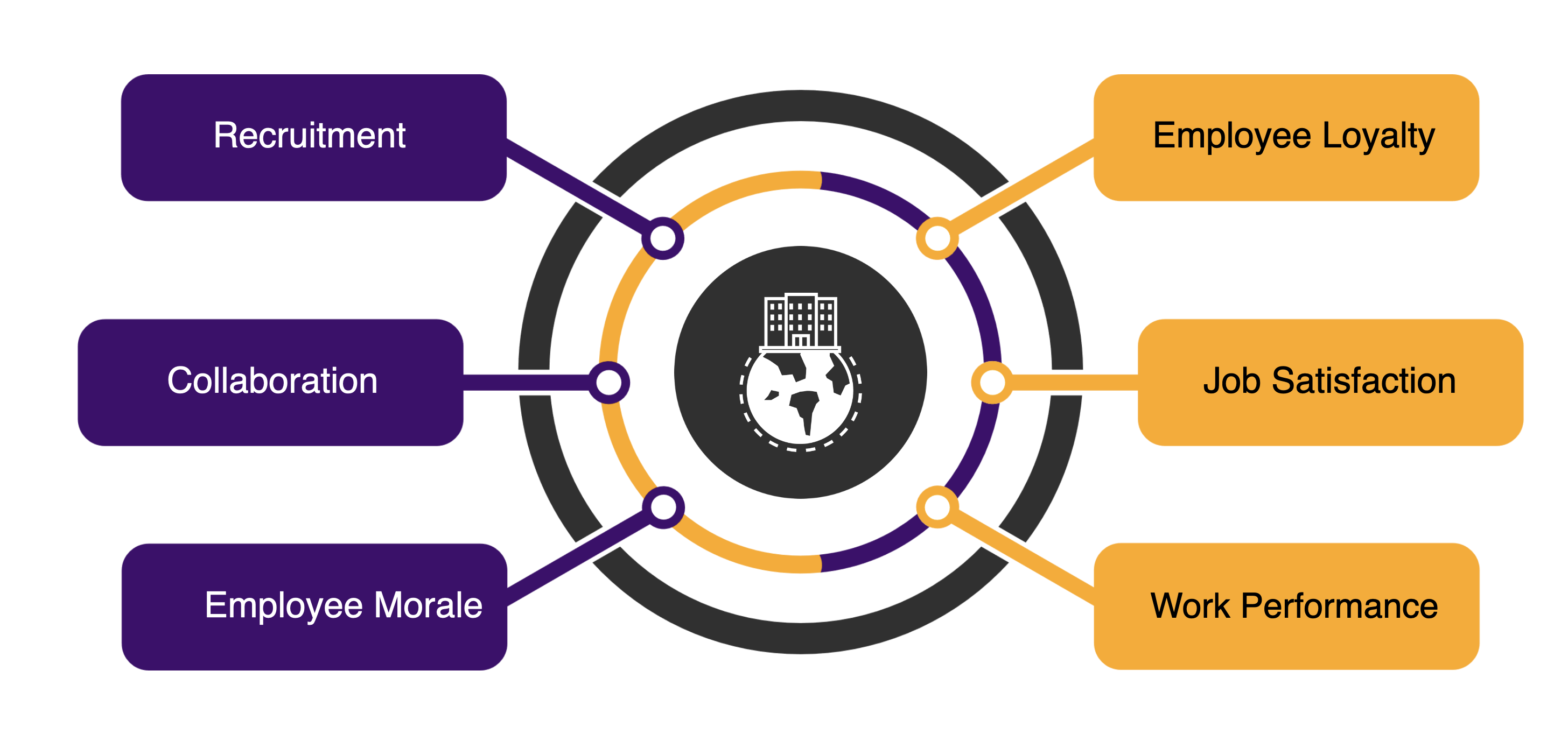

Positive collaboration

Positive collaborationThrough implementing a thorough healthcare program, we can boost staff morale and educate them to prevent unnecessary costs from providers.

Sense Of Value

Sense Of ValueBy engaging TPA, Companies effortlessly conduct sessions like wellness, chronic disease management that provides a lot of value to the employees and this can give a good branding of being a Good Employer.

Loyal Workforce

Loyal WorkforceOften, companies struggle to retain employees, particularly skilled ones. Engaging with a Third-Party Administrator (TPA) can help your company become a Preferred Employer.

Making Tough Decisions

Making Tough DecisionsWhen employees have tough decisions to make regarding their health, such as surgeries or procedures, there is always someone available to support them throughout the entire process.

Slow Productivity

Slow ProductivityWorkers struggle with chronic conditions and find it challenging to fully recover and return to work because of non-compliance with medication or unhealthy lifestyle choices.

Exclusivity

ExclusivityThe company needs someone to address daily employee issues and ensure that their well-being is taken care of to maintain productivity.

Potential Challenges With A Clinical Care Management

Clinical care management is an essential administrative program that oversees the medical aspect of healthcare. Third-party administrators (TPAs) help guide members through clinical care paths to identify the most effective and cost-efficient care options. By working closely with healthcare providers, TPAs coordinate care for employees with complex medical needs, ensuring they receive personalized, high-quality care.

Employers can utilize TPAs' clinical care management services to lower costs in various areas such as emergency room visits, maternal health, radiology, and inpatient services. Our organization offers efficient clinical care management solutions, directing employees towards appropriate care options for long-term, preventive, physical, behavioral, or at-home requirements. Given that healthcare spending exceeds RM30,000 per insured member annually, understanding service choices and expenses is vital for optimizing healthcare benefits plans.

Our clinical care management programs have been proven to be effective, streamlined, and cost-effective. An evaluation conducted by the independent actuarial firm demonstrated that our programs resulted in a 30% decrease in overall utilization, including in-patient expenses and emergency room visits.

Steps of employers can take to better partner with a TPA

Evaluating TPAs and making the change

Engaging with a Third-Party Administrator (TPA) comes with numerous benefits for benefit plans and HR departments. However, what qualities make a TPA the perfect match? For employers new to TPA partnerships or beginning the search for one, understanding your company's needs and expectations from an administrative partner is crucial. A successful TPA collaboration should encompass the following key elements:

- Providing employers to comprehend their health plan options effectively.

- Offering high-quality, flexible, and customized solutions to meet current requirements.

- Partnering with an adaptable entity that delivers a wide array of detailed, precise, insightful, and supportive reports.

After onboarding a TPA partner, cost savings and enhanced employee satisfaction should start to materialize. While the outcomes and savings are not immediate, over the course of a few years, the advantages of transitioning to a self-funded, TPA-managed plan will become evident. Here are a few annual self-assessment questions for employers to gauge the impact of this change on their organization:

When to Consider a Self-funded Health Plan

Healthcare remains a substantial expense for employers, with anticipated further increases in costs. To manage expenses effectively, employers are looking into self-funded plan alternatives. Choosing this option can be the most efficient way to control employer costs and improve the accessibility of health plans for employees. When considering a self-funded strategy, it is recommended to work with a TPA or consultant to ensure the transition timing is right. Moreover, employers should take into account several factors, including:

Why Self-fund?

Why Self-fund?Healthcare costs are a significant expense for employers, leading many to adopt self-funded plans to contain costs. Working with a TPA or consultant is advised to determine the right time for the switch, ensuring affordability for employees.

Analysis

AnalysisAnalyze claims data to determine total expenditure and the payment status of both current and past claims.

Age based coverage

Age based coverageConsider employee age range and health. Offer wellness programs tailored to different needs. Encourage health check-ups, work-life balance, and provide resources like educational materials and mental health support for overall well-being, leading to increased productivity and job satisfaction.

Cost efficiency

Cost efficiencyExamine the benefits that are utilized the most and the least. Employers might discover opportunities to cut some benefits, explore more cost-effective alternatives for others, or enhance benefits in areas with high usage.

Contribute To The Diversification Of The Workforce

Contribute To The Diversification Of The WorkforceTo enhance productivity, reduce costs, and prevent resource wastage, it is crucial to have access to up-to-date data and reports for review.

Making a Change

How eBen can assist you?

Question 1

Question 1

- Have I noticed a significant impact on healthcare spending or an improvement in the trend of my healthcare expenses?

- Does my TPA have a practical strategy in place to aid in cost reduction?

Question 2

Question 2

- Do I have access to real-time data for optimizing my plan before open enrollment?

- Are my employees receiving payments or reimbursements promptly?

Question 3

Question 3

- Is the care management at my current TPA effectively guiding employees to the most advantageous care settings, aiding in cost reduction, and increasing their chances of improving health successfully?

- How satisfied are my employees with their overall experience?

Preventive Care

We believe in preventive care rather than curative. Our specially customized program allows our client not only to become an award winner organization in staff welfare, but we also cater for those with strict authorities requirements in screening prior to work. As a result, we are proud to say that we are acknowledged by industries like Shipping, Pilots, Oil & Gas and also Occupational Health and Safety (DOSH).

Why Screening?

Why Screening?It is important to have the baseline assessment performed before commencing work to protect the employers from being sued or queried by the authorities like SOCSO, DOSH, or Labour Office.

Rehabilitation

RehabilitationIt is important to have the rehabilitation executed to reduce MCs and increase productivity. Our experience with our clients shows that we have close to 90% return to work program effectively executed once we commence this program

Age based coverage

Age based coverageConsider employee age range and health. Offer wellness programs tailored to different needs. Encourage health check-ups, work-life balance, and provide resources like educational materials and mental health support for overall well-being, leading to increased productivity and job satisfaction.

Cost efficiency

Cost efficiencyOur clients whom have conducted such a regime experienced a 50% cost savings due to availability of group rates and cashless facilities made available for employees.

Retention Tool

Retention ToolPreventive care is a retention tool to organisations whom have experienced 80% reduction year by year. This is because employees believe in managing the health regime better creating satisfaction